Journal Entry For Withdrawal Of Goods For Personal Use . when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. It is the owner’s withdrawal as they decide to take the. The withdrawal of cash by the owner for personal use is recorded on a temporary. we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. journal entry for goods withdrawn for personal use. please prepare a journal entry for withdrawal of goods for personal use. The accounting records will show the following. drawings accounting bookkeeping entries explained.

from www.chegg.com

The accounting records will show the following. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. please prepare a journal entry for withdrawal of goods for personal use. drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. journal entry for goods withdrawn for personal use. It is the owner’s withdrawal as they decide to take the. drawings accounting bookkeeping entries explained. The withdrawal of cash by the owner for personal use is recorded on a temporary. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use.

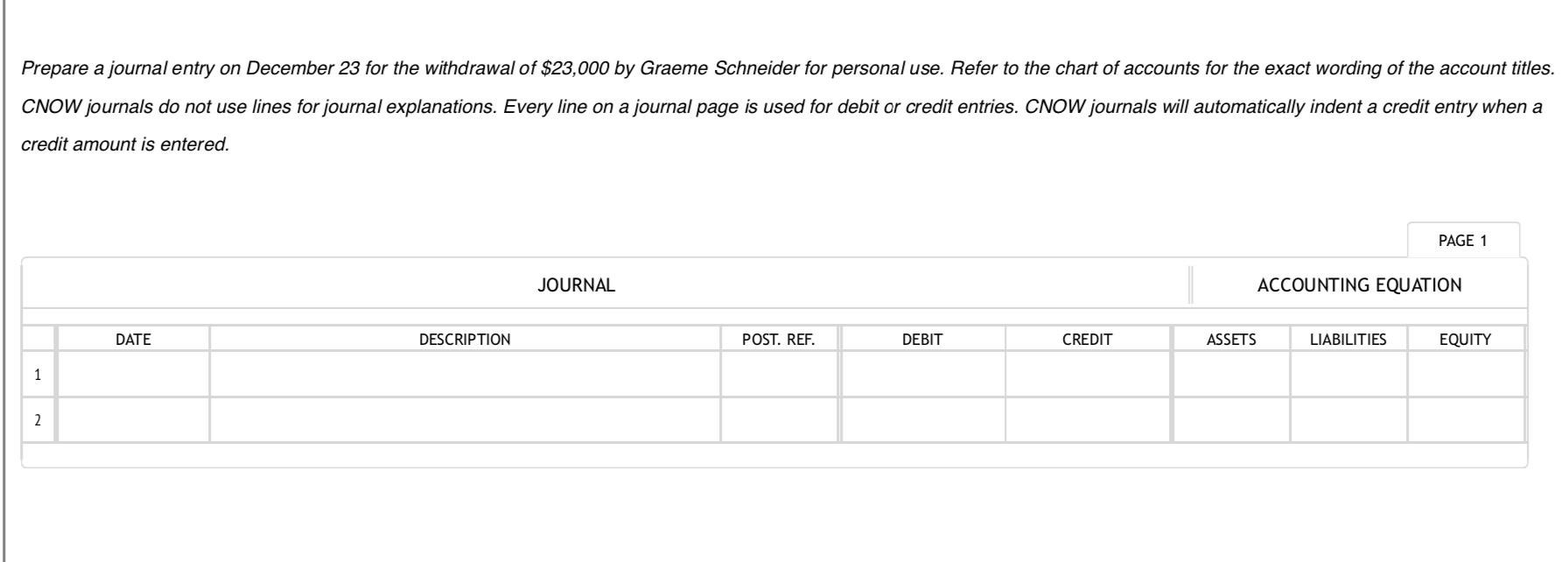

Solved Prepare a journal entry on December 23 for the

Journal Entry For Withdrawal Of Goods For Personal Use we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. It is the owner’s withdrawal as they decide to take the. journal entry for goods withdrawn for personal use. drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. The withdrawal of cash by the owner for personal use is recorded on a temporary. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. please prepare a journal entry for withdrawal of goods for personal use. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. drawings accounting bookkeeping entries explained. The accounting records will show the following.

From touch4career.com

Goods withdrawn by owner of 1000 for personal use Ch 8 Journal Journal Entry For Withdrawal Of Goods For Personal Use The withdrawal of cash by the owner for personal use is recorded on a temporary. journal entry for goods withdrawn for personal use. drawings accounting bookkeeping entries explained. drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. we can make the journal entry for the cash withdrawn for. Journal Entry For Withdrawal Of Goods For Personal Use.

From cekplmqt.blob.core.windows.net

Journal Entry For Goods Withdrawn For Office Use at Patricia Hurst blog Journal Entry For Withdrawal Of Goods For Personal Use It is the owner’s withdrawal as they decide to take the. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. when you take money. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.youtube.com

Journal entry for cash withdrawal from bank YouTube Journal Entry For Withdrawal Of Goods For Personal Use drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. It is the owner’s withdrawal as they decide to take the. please prepare a journal entry for withdrawal of goods for personal use. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals. Journal Entry For Withdrawal Of Goods For Personal Use.

From dxootjeab.blob.core.windows.net

If We Take Goods For Own Use Journal Entry at Duane Delgado blog Journal Entry For Withdrawal Of Goods For Personal Use The withdrawal of cash by the owner for personal use is recorded on a temporary. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. please prepare a journal entry for withdrawal of goods for personal use. journal entry for goods withdrawn for personal use. . Journal Entry For Withdrawal Of Goods For Personal Use.

From www.studocu.com

Owner withdrawal Note Owner withdrawal journal entry Sometimes, the Journal Entry For Withdrawal Of Goods For Personal Use The withdrawal of cash by the owner for personal use is recorded on a temporary. It is the owner’s withdrawal as they decide to take the. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. drawings of stock implies stock or goods taken away by the. Journal Entry For Withdrawal Of Goods For Personal Use.

From leaningonline.blogspot.com

Journal Entry For Goods Withdrawn For Office And Personal Use Journal Entry For Withdrawal Of Goods For Personal Use The withdrawal of cash by the owner for personal use is recorded on a temporary. The accounting records will show the following. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. please prepare a journal entry for withdrawal of goods for personal use. It is the. Journal Entry For Withdrawal Of Goods For Personal Use.

From hadoma.com

Journal entries Meaning, Format, Steps, Different types, Application Journal Entry For Withdrawal Of Goods For Personal Use we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. The withdrawal of cash by the owner for personal use is recorded on a temporary. drawings accounting bookkeeping entries explained. drawings of stock implies stock or goods taken away by the proprietor or partner for personal. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.chegg.com

Solved Prepare a journal entry on December 23 for the Journal Entry For Withdrawal Of Goods For Personal Use The withdrawal of cash by the owner for personal use is recorded on a temporary. drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. It is the owner’s withdrawal as they decide to take the. journal entry for goods withdrawn for personal use. The accounting records will show the following.. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.youtube.com

Withdraw Cash for Personal Use Entry in Tally Prime Drawing to Cash Journal Entry For Withdrawal Of Goods For Personal Use journal entry for goods withdrawn for personal use. It is the owner’s withdrawal as they decide to take the. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. drawings accounting bookkeeping entries explained. please prepare a journal entry for withdrawal of goods for personal. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.accountancyknowledge.com

Journal Entry Problems and Solutions Format Examples MCQs Journal Entry For Withdrawal Of Goods For Personal Use we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. drawings accounting bookkeeping entries explained. The withdrawal of cash by the owner for personal use is recorded on a. Journal Entry For Withdrawal Of Goods For Personal Use.

From jkbhardwaj.com

Cash Withdrawal from Bank Journal Entry Bhardwaj Accounting Academy Journal Entry For Withdrawal Of Goods For Personal Use The accounting records will show the following. please prepare a journal entry for withdrawal of goods for personal use. drawings accounting bookkeeping entries explained. drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. journal entry for goods withdrawn for personal use. we can make the journal entry. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.meritnation.com

what is the journal entry for 1)withdrew cash for office use 2 Journal Entry For Withdrawal Of Goods For Personal Use The withdrawal of cash by the owner for personal use is recorded on a temporary. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. It. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.brainkart.com

Journal entries Meaning, Format, Steps, Different types, Application Journal Entry For Withdrawal Of Goods For Personal Use journal entry for goods withdrawn for personal use. we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. when you take money out of. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.youtube.com

Tally. ERP 9 Withdraw Transaction for personal use in Hindi (www Journal Entry For Withdrawal Of Goods For Personal Use The withdrawal of cash by the owner for personal use is recorded on a temporary. drawings accounting bookkeeping entries explained. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. we can make the journal entry for the cash withdrawn for personal use by debiting the. Journal Entry For Withdrawal Of Goods For Personal Use.

From thedebitcredit.co.in

Cash withdrawn for personal use journal entry The debit credit Journal Entry For Withdrawal Of Goods For Personal Use The accounting records will show the following. The withdrawal of cash by the owner for personal use is recorded on a temporary. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. journal entry for goods withdrawn for personal use. It is the owner’s withdrawal as they. Journal Entry For Withdrawal Of Goods For Personal Use.

From schematiclistgeraniol.z13.web.core.windows.net

Journal Entry Transactions Examples Pdf Journal Entry For Withdrawal Of Goods For Personal Use journal entry for goods withdrawn for personal use. when you take money out of your business, you need to make a journal entry for cash withdrawn for personal use. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. It is the owner’s withdrawal as they. Journal Entry For Withdrawal Of Goods For Personal Use.

From fundsnetservices.com

Journal Entry Examples Journal Entry For Withdrawal Of Goods For Personal Use we can make the journal entry for withdrawal of goods for personal use by debiting the withdrawals account and crediting the. we can make the journal entry for the cash withdrawn for personal use by debiting the withdrawals account and crediting the. when you take money out of your business, you need to make a journal entry. Journal Entry For Withdrawal Of Goods For Personal Use.

From www.youtube.com

Cash withdrawal by owner for Personal use, Accounting entry in Tally Journal Entry For Withdrawal Of Goods For Personal Use drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. The accounting records will show the following. drawings accounting bookkeeping entries explained. journal entry for goods withdrawn for personal use. It is the owner’s withdrawal as they decide to take the. we can make the journal entry for withdrawal. Journal Entry For Withdrawal Of Goods For Personal Use.